Navigating the Medicare Annual Enrollment Period

- Michael Braden

- Jan 7

- 4 min read

Updated: Jan 8

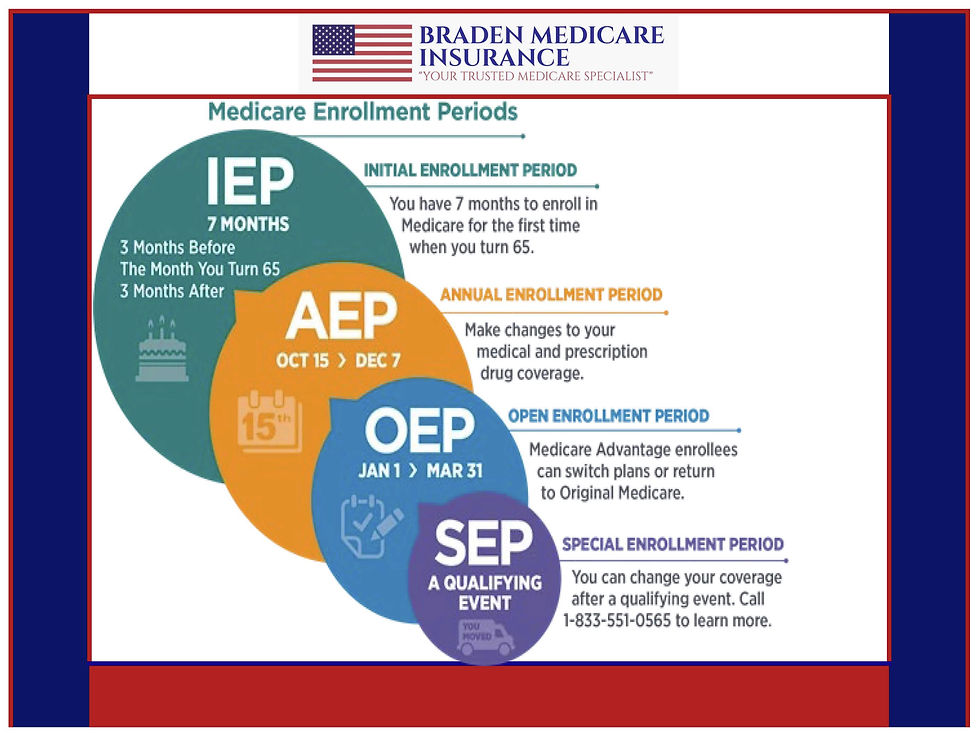

Understanding Medicare and its enrollment options can be overwhelming. Each year, millions of people review and adjust their Medicare plans during the Medicare Annual Enrollment Period. This period is crucial for ensuring you have the right coverage to meet your health needs and budget. This guide will help you navigate the process with confidence and clarity.

Understanding the Medicare Enrollment Period

The Medicare enrollment period is a designated time each year when beneficiaries can make changes to their Medicare coverage. This period typically runs from October 15 to December 7 annually. During this time, you can:

Switch from Original Medicare to a Medicare Advantage plan.

Change from one Medicare Advantage plan to another.

Enroll in a Medicare Part D prescription drug plan.

Drop your Medicare prescription drug coverage.

Making changes during this period ensures your coverage will be adequate starting January 1 of the following year. It is essential to review your current plan carefully and consider any changes in your health needs or budget before making decisions.

How to Prepare for the Medicare Enrollment Period

Preparation is key to making the most of the Medicare enrollment period. Here are some practical steps to help you get ready:

Review Your Current Coverage

Look at your current Medicare plan details, including premiums, deductibles, copayments, and coverage limits. Consider whether your plan still meets your health needs.

Assess Your Health Needs

Think about any changes in your health or medications over the past year. Are there new prescriptions or treatments you need covered?

Compare Plans

Use online tools or consult with a Medicare expert to compare available plans in your area. Pay attention to costs, coverage options, and provider networks.

Gather Important Documents

Have your Medicare card, current plan information, and a list of medications handy. This will make the enrollment process smoother.

Mark Your Calendar

Don’t miss the enrollment window. Set reminders to review and submit your plan changes before the deadline.

Taking these steps will help you make informed decisions and avoid costly mistakes.

What is the difference between Medicare OEP and AEP?

Two critical enrollment periods often confuse: the Open Enrollment Period (OEP) and the Annual Enrollment Period (AEP). Understanding the difference can help you determine when and how to adjust your Medicare coverage.

Annual Enrollment Period (AEP)

This is the main enrollment window from October 15 to December 7. During AEP, you can make a wide range of changes to your Medicare plans, including switching between Original Medicare and Medicare Advantage, changing Medicare Advantage plans, or enrolling in or dropping Part D prescription drug coverage.

Open Enrollment Period (OEP)

The OEP runs from January 1 to March 31 each year. It is more limited in scope. During OEP, if you are already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or return to Original Medicare. However, you cannot join a Medicare Advantage plan if you are not already enrolled in one, nor can you add or drop Part D coverage during this time.

Knowing these differences helps you plan your coverage changes effectively and avoid missing important deadlines.

Tips for Choosing the Right Medicare Plan

Choosing the right Medicare plan can be challenging, but focusing on your personal needs will guide you to the best choice. Here are some tips:

Consider Your Health Care Providers

Check if your preferred doctors and hospitals are included in the plan’s network.

Evaluate Prescription Drug Coverage

Ensure the plan covers your medications and review the associated costs.

Look at Total Costs

Don’t just focus on monthly premiums. Consider deductibles, copayments, and coinsurance.

Check Extra Benefits

Some Medicare Advantage plans offer additional benefits such as dental, vision, and hearing coverage.

Use Available Resources

Utilize Medicare’s official tools or consult with licensed agents who can provide personalized advice.

By carefully weighing these factors, you can select a plan that fits your health needs and financial situation.

How to Enroll or Make Changes During the Medicare Annual Enrollment Period

When you are ready to enroll or make changes, follow these steps:

Visit the Official Medicare Website or Contact a Licensed Agent

You can enroll online, by phone, or with the help of a Medicare counselor.

Review Your Choices

Double-check the plan details, costs, and coverage before submitting your application.

Submit Your Enrollment or Change Request

Make sure to complete the process before the December 7 deadline.

Keep Confirmation Records

Save any confirmation numbers or emails you receive for your records.

Monitor Your Mail

You will receive a new Medicare card or plan documents before your coverage starts on January 1.

If you need assistance, many organizations offer free counseling to help you understand your options.

Staying Informed Beyond the Enrollment Period

Medicare coverage and rules can change each year. Staying informed helps you avoid surprises and ensures you always have the best coverage for your needs.

Read Annual Notices

Every fall, your plan will send an Annual Notice of Change (ANOC) explaining any changes for the following year.

Review Your Coverage Annually

Even if you don’t plan to change your plan, review your coverage each year during the enrollment period.

Ask Questions

Don’t hesitate to contact Medicare or a trusted advisor if you have questions about your coverage.

Keep Track of Deadlines

Mark important dates on your calendar to avoid missing enrollment opportunities.

By staying proactive, you can maintain peace of mind about your healthcare coverage.

For more detailed information and personalized assistance, visit the Medicare Annual Enrollment Period page to explore your options and get expert guidance.

_AZ_Initial.png)