WHAT IS THE BEST OPTION: MEDICARE ADVANTAGE OR ORIGINAL MEDICARE WITH A MEDICARE SUPPLEMENT PLAN

- Michael Braden

- Jan 2

- 11 min read

Updated: Jan 6

Michael T. Braden October 11, 2025 MEDICARE 101

MEDICARE SUPPLEMENT vs MEDICARE ADVANTAGE, which option is better? This has been an ongoing battle for decades and will continue for the foreseeable future.

It is one of the most common and confusing decisions people face when enrolling in Medicare.

We hope that by reading this guide and sharing it with friends or family members, you will better understand the differences between Medicare Advantage Plans (Medicare Part C) and Medicare Supplement (Medigap) plans, including costs, coverage, provider access, enrollment rules, and long-term flexibility. Whether you’re deciding for the first time or reconsidering your current coverage, we hope this article helps you determine which Medicare plan is best for your healthcare needs, travel habits, and budget, without the jargon or sales pressure.

MEDICARE DOES NOT COVER EVERYTHING

The first shock for many people upon retirement is learning that Medicare does not cover everything. For example, Original Medicare Medicare (Medicare Part A & Medicare Part B) does not provide Coverage for Routine Dental, Vision, or hearing visits or examinations.

These are just a few of the reasons that Medicare Advantage plans were established. Because Medicare Advantage plans are offered by private, for-profit insurance companies, these companies are not subject to Medicare rules.

The Government pays these private insurance companies $ 12,000 per year for each of their Medicare Beneficiaries. This additional income funds the extra coverage and, unfortunately, the Medicare Advantage commercials we see on TV and hear on the radio.

Here are some of the significant differences between Medicare Supplement plans and Medicare Advantage:

Medicare Advantage plans typically offer lower premiums and additional benefits, but often impose significant network restrictions. In contrast, Medigap plans cover more out-of-pocket expenses, and are accepted by any provider who already accepts Medicare- no network necessary.

Understanding enrollment periods, plan limitations, and costs is essential for making informed decisions about whether to choose a Medicare Advantage plan (Medicare Part C) or a Medicare Supplement plan.

Typically, Medicare Advantage offers no coverage outside of the County you live in, except for Urgent Care or using a Hospital Emergency Room.

Typically, people are interested in the fact that most Medicare Advantage Plans have $0 or very low monthly premiums. However, your costs quickly add up due to the number of copayments and coinsurance you are responsible for.

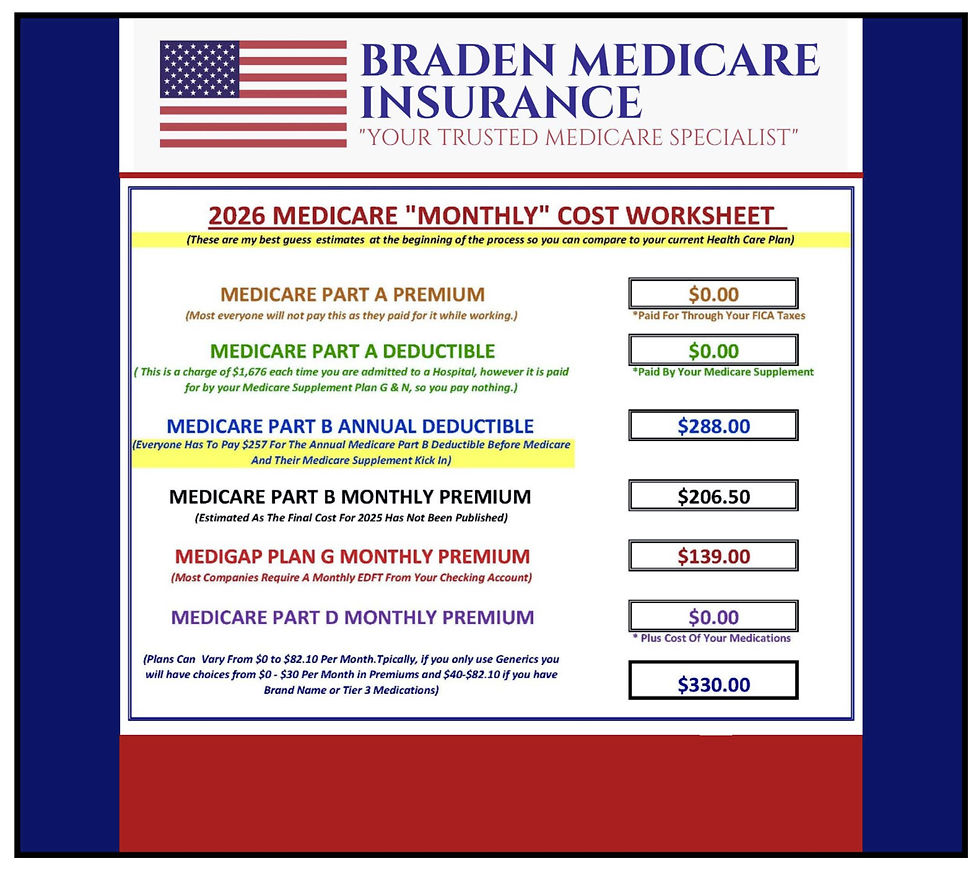

Any of you who can remember the old Midas commercials from the 80s might recall the tagline: "You can pay me now, or pay me later." Well, Medicare Supplement Plans are similar to the pay ahead of time, you have a consistent monthly payment, and you are covered for pretty much everything else, and your only expense will be an annual Medicare Part B deductible, which is $288 for 2026.

Medicare Advantage Plans have little or no premiums, but they nickel and dime you for everything else. Including the need to receive a referral from your PCP before seeing a specialist, $300 per day for Hospital Stays, $250 and up for MRI or CT Scans, etc. They can also delay or deny services and require you to obtain 2nd, 3rd, and even 4th opinions in some cases.

Original Medicare covers most services you would see an Ophthalmologist for; however, it does not cover expenses at an Optometrist's office.

MEDICARE HAS 4 PARTS

WHAT IS MEDICARE ADVANTAGE?

Medicare Advantage, also referred to as Part C, is an alternative to traditional Medicare. Private insurers provide Advantage Plan coverage. These plans cover the same essential dynamics as Parts A and B of Original Medicare and may also include additional services, yet lack the coverage flexibility that Original Medicare offers.

Advantage plans often offer additional benefits, such as vision, dental, and hearing coverage. Many Advantage plans also include prescription drug coverage, and some even include telehealth services.

DIFFERENT TYPES OF MEDICARE ADVANTAGE PLANS

Advantage plans are primarily categorized as Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs). HMOs generally require you to use a specific network of doctors and hospitals, and typically require referrals to see specialists. PPOs offer slightly more flexibility, allowing you to see out-of-network providers, but at a higher cost.

Most Medicare Advantage plans operate under an HMO or PPO structure. Some plans cover a portion of out-of-network care, while others strictly cover only in-network services.

WHAT ARE THE COSTS AND PREMIUMS FOR MEDICARE ADVANTAGE

Advantage plans are known for their lower premiums compared to Medigap plans, with many offering no-cost premiums. However, that comparison is not relevant because an Advantage plan competes only with Original Medicare without a supplement. The benefits are not equal to Medicare plus a supplement.

In 2025, the average monthly premium for these plans is approximately $17, with a substantial number of plans having no premium. However, it’s essential to consider other notable expenses, such as copayments, the monthly Part B premium, and out-of-network service costs.

The federal government requires these plans to limit the out-of-pocket maximum, with current caps set at $9,350 for in-network services. This cap helps protect beneficiaries from high medical costs, though additional fees may still arise.

WHAT IS MEDIGAP?

Medigap plans, also referred to as Medicare Supplement plans, fill coverage gaps in Original Medicare (Parts A and B). A Medigap policy helps cover expenses that you would otherwise need to pay out of pocket, such as copayments, coinsurance, and deductibles. There are several plan choices available, offering a variety of coverage options. For more details, see the Medicare Supplement Plans Comparison Chart.

One significant advantage of Medigap plans is that the policies are automatically renewed each year -as long as premiums continue to remain paid- which ensures continuous coverage regardless of your current health status.

COMPARING MEDICARE SUPPLEMENT PLANS

These plans cover various deductibles, copayments, and coinsurance under Original Medicare. Some plans, such as Plan F, even cover costs not included in Medicare, such as the Part A deductible and overseas care.

MEDICARE SUPPLEMENT COSTS DEPEND ON THE MEDICARE SUPPLEMENT PLAN YOU CHOOSE

Medigap premiums vary significantly, based on the insurance company you choose, your location, and age. These plans often involve minimal additional costs, even for frequent medical care, making them a predictable option for budgeting.

Missing the Initial Enrollment Period may result in higher premium costs or denial of coverage due to medical underwriting.

COMPARING MEDICARE SUPPLEMENTS AND MEDICARE ADVANTAGE

Choosing between Advantage and Medigap plans involves comparing their benefits and costs:

A Medicare Advantage Plan replaces Medicare Part A, Part B, and often Part D. The Advantage plan is best compared to Original Medicare without a supplement. Unlike a Medicare supplement, an Advantage plan does not increase your benefits relative to Original Medicare.

A Medigap Plan increases the benefit of Original Medicare by paying all or some of the copays and deductible in Medicare Part A and Part B.

Medigap allows access to any doctor who already accepts Original Medicare, providing greater provider-network flexibility compared with Advantage plans, most of which require care within the plan’s network.

Medicare Advantage plans often include additional benefits, such as vision and dental care, that Original Medicare does not cover. Even with these extra benefits, premiums for Advantage plans are typically lower than Medigap premiums; several plans have a $0 premium. Many Medicare Advantage plans also include prescription drug coverage.

WILL YOUR PLAN TRAVEL WITH YOU?

Patients with Medicare Advantage plans (Medicare Part C) may face limitations on provider choice due to the plans’ network restrictions. Coverage for Advantage Plans, while still regulated by Medicare, is provided through private companies that contract with specific in-network hospitals and physicians. Most Medicare Advantage plans restrict you to in-network medical providers, which can be significant if you have preferred doctors outside the network or need to see a specialist. If you want to stay with a specific doctor or hospital while enrolling in Medicare, ask whether they participate in any Advantage plans or accept Original Medicare.

Advantage plans may be less suitable for Medicare beneficiaries who travel frequently, due to network restrictions. Medigap plans, however, typically allow members to access any Medicare-accepting provider nationwide.

For those who travel abroad, combining Original Medicare with a Medigap plan that covers overseas emergency care can provide assurance and comprehensive coverage wherever they go.

DIFFERENCES IN COVERAGE WITH MEDICARE ADVANTAGE AND MEDIGAP PLANS

Medigap and Medicare Advantage plans differ in coverage and benefits:

Medigap does not include coverage for prescription medications; a separate Part D plan is required for drug coverage.

Advantage plans often include additional benefits, such as dental, vision, and hearing coverage, and some also include gym memberships.

Plans K and L have out-of-pocket limits that can help manage beneficiaries' costs.

Understanding out-of-pocket maximums is crucial, as they can significantly affect overall healthcare expenses. Using online comparison tools and resources can help evaluate the differences in coverage and costs among Medicare insurance plans, including prescription drugs.

CHOOSING THE RIGHT PLAN FROM THE START

When deciding between Medicare Advantage and a supplement, it’s crucial to assess your personal health, lifestyle, and financial needs. Consider your preferred method of healthcare and frequency of medical care. If you have specific health conditions or require frequent medical services, this will undoubtedly influence your choice.

Certified Medicare advisors can provide tailored recommendations based on individual health needs and financial circumstances. They can clarify the complexities of Medicare options and help ensure that you make an informed decision.

SPECIAL NEEDS PLANS AND CHRONIC SPECIAL NEEDS PLANS

Medicare Advantage Special Needs Plans are designed for individuals with significant healthcare needs and are available to Advantage enrollees with specific chronic conditions, offering tailored care and services.

Ignoring potential future healthcare needs can lead to selecting a plan that may not provide adequate coverage in the future. Planning for future medical needs, such as chronic conditions or poor health, is essential for making an informed decision regarding Medicare coverage.

BUDGETS ARE DIFFERENT FOR EVERYONE

To determine overall expenses for both plans, consider the following:

Calculate all costs associated with each plan, including copayments and deductibles.

Account for variations in Medigap plan premiums by age.

Consider location-based differences in pricing.

Failing to understand how out-of-pocket costs accumulate can impact decision-making regarding plan selection. Evaluating both cost and coverage options, including prescription drug needs, is crucial when selecting between Medicare Advantage and Medigap.

HSA ACCOUNTS

If you have a Health Savings Account (HSA), it’s essential to understand how HSAs interact with Medicare, especially regarding rules like when to stop contributions and when to sign up for Medicare coverage.

KNOWING THE CORRECT ENROLLMENT PERIODS IS IMPORTANT

Understanding Medicare enrollment periods is crucial for making changes to your coverage without incurring penalties. Advantage plans typically offer three enrollment options: the Initial Enrollment Period, Annual Election Period (October 15 to December 7), and Medicare Advantage Open Enrollment (January 1 to March 31).

INITIAL ENROLLMENT PERIOD (IEP)

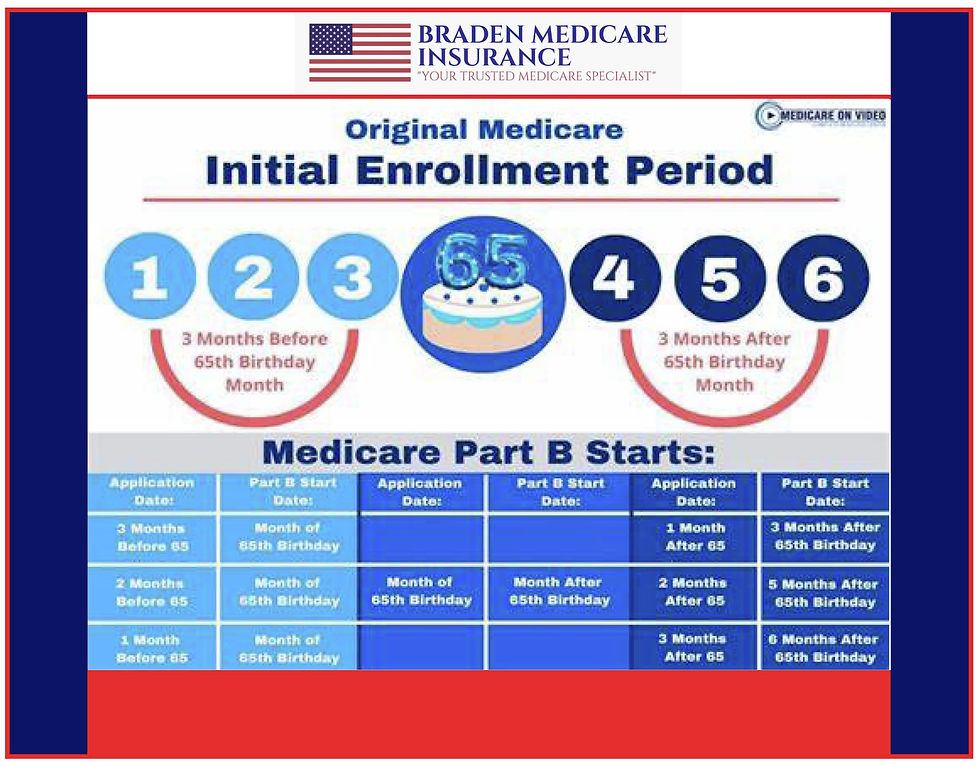

You should enroll in Medicare Parts A and B during a specific seven-month ‘Initial Enrollment’ time window, which starts three months before you turn 65, includes that birthday month, and continues for the three consecutive months after. This period is crucial because it guarantees the right to coverage, meaning insurance companies cannot deny coverage or charge higher premiums based on health conditions.

The best time to purchase a Medigap/supplement plan is during the six months immediately following enrollment in Medicare Part B, typically when you turn 65. During this “Initial Enrollment Period,” the 6-month/180-day timeframe after starting Part B, insurance companies must allow you to choose a supplement plan without consideration of your health status, which is why this is the most preferred time to acquire your medigap plan.

If you’re receiving Social Security benefits, you’ll be automatically enrolled in Medicare when you become eligible. Those not yet receiving these benefits can enroll online or at their local Social Security Administration office. For information on prescription drug coverage, review how to enroll in Medicare Part D.

MEDICARE ANNUAL ELECTION PERIOD (AEP)

During the Annual Election Period from October 15 to December 7, Medicare beneficiaries can add or switch their Medicare Part D coverage. This period also allows beneficiaries to transition from Medigap to an Advantage plan.

Annual reviews during the Annual Election Period ensure your coverage continues to meet your healthcare needs. Premiums, coverage options, and healthcare needs can change from year to year, making these reviews critical.

OTHER SPECIAL ENROLLMENT PERIODS (SEP)

Medicare allows special enrollment periods for individuals who experience specific life changes, such as moving out of their plan’s service area or ending employer-sponsored health coverage. If you lose your employer health insurance, you can enroll in Medicare during a special eight-month enrollment period. Make sure to consult a Medicare expert to explain these time frames so that you can make the best decision at the right time for you.

Special enrollment periods provide flexibility for those who experience unexpected changes in their health insurance coverage, ensuring they can maintain their benefits without penalties.

AVOIDING COMMON MEDICARE MISTAKES

Confusing Medicare Advantage and Medigap coverage. Thinking that Advantage and Medigap plans provide identical coverage is also a standard error. It is essential to understand the differences between these plans to make the right choice.

Overlooking the loss of guaranteed-issue rights. Switching from Medigap to Advantage may cause you to lose certain guaranteed-issue rights for Medigap coverage later. Being aware of this is essential to avoid unexpected issues.

Not thoroughly researching plan benefits. Failing to fully study and understand what each plan offers before switching can lead to surprises, which you’d prefer to minimize when it comes to your health care.

Ignoring out-of-pocket cost limits, many overlook the differences in out-of-pocket limits between Medicare Advantage and Medigap plans. These limits significantly impact overall healthcare expenses and budgeting.

Neglecting to consider future healthcare needs. Not planning for future medical care can be problematic, mainly because once a supplemental policy is canceled, regaining coverage may be difficult. Anticipating future health needs is crucial for making informed decisions.

CAN YOU SWITCH BACK AND FORTH BETWEEN PLANS

Switching between Medicare Advantage and Medigap requires returning to Original Medicare first. Understand the specific steps and considerations for changing plans to avoid any coverage gaps.

Many individuals consider switching from a Medicare Advantage plan to Medigap for more choice in specialists and less hassle involving prior authorizations. Conversely, switching from Medigap to a Medicare Advantage option requires careful consideration of the potential loss of specific Medigap benefits.

SWITCHING FROM MEDICARE ADVANTAGE TO A MEDICARE SUPPLEMENT PLAN

To switch from a Medicare Advantage plan to Medigap, you must make this coverage change during the Annual Election Period. When switching back to Original Medicare, you will need to enroll in a Medicare Part D plan at the same time.

In some states, individuals are offered guaranteed-issue Medigap plans year-round without medical underwriting. However, if you have a pre-existing condition when applying for Medigap coverage after switching plans, insurers may deny coverage or offer it at a higher premium.

When considering changes to Medicare coverage, it is imperative to seek knowledgeable advice and guidance from a qualified Medicare expert. They will be able to help you navigate all necessary steps within specified time frames, providing invaluable assurance during the process.

SWITCHING FROM MEDICARE SUPPLEMENT TO A MEDICARE ADVANTAGE PLAN

Check if your Medigap policy has any specific contract requirements regarding switching. You may lose specific Medigap benefits when switching to a Medicare Advantage plan.

Understanding these implications is crucial to making an informed decision that aligns with your healthcare needs and financial situation.

Key Tips for Making the Best Choice

Research and Compare Plans: Thoroughly research all available Medicare options, including Medicare Advantage and Medigap plans, to understand their coverage, costs, and provider networks. Consider your health needs, budget, lifestyle, and any existing insurance coverage to make an informed decision about which plan best suits you.

Consult with Experts: Seek guidance from Medicare specialists or licensed insurance advisors who can provide personalized recommendations tailored to your unique healthcare requirements and financial situation. Consulting with experts can help clarify potentially complex options as you enroll in Medicare and ensure that you choose the best plan for your needs.

Review Annual Changes: Regularly review your Medicare Advantage or Medicare Supplement plans during the annual open enrollment period to ensure they continue to meet your evolving health needs. You can also use resources such as Medicare.gov to research and compare plans and make adjustments as necessary.

WRAPPING THINGS UP

Choosing between Medicare Advantage and a Medicare Supplement (Medigap) plan is a significant decision that can affect your healthcare and finances. While Medicare Advantage plans offer lower premiums and additional benefits, such as vision and dental care, they come with network restrictions. In contrast, Medigap plans provide greater flexibility in choosing medical providers and cover more out-of-pocket costs.

Ultimately, the best choice depends on your health needs, budget, and lifestyle. By conducting thorough research, consulting experts, and reviewing your plan annually, you can ensure that you select the plan that best meets your needs. Make an informed decision today to secure a healthier and more financially stable future.

_AZ_Initial.png)