YOUR ROADMAP FOR ENROLLING IN MEDICARE

- Michael Braden

- 5 days ago

- 8 min read

Michael T. Braden February 1, 2026 MEDICARE ENROLLMENT

As advanced as the United States is in many areas of society and innovation, we have never developed a foolproof mechanism for teaching individuals about Medicare, and specifically, when and how to enroll in Medicare.

Something that most Medicare beneficiaries learn the hard way is that the federal government does not notify them when it is time to enroll in Medicare. They expect you to know how to apply for Medicare and when and how to proceed with the process, based on your timeline. Medicare still has a strong reputation for having many moving parts and numerous rules to understand, making it overwhelming and confusing.

The more people understand about Medicare, what it is and how it works, the less daunting the process of enrolling in Medicare becomes. By following this Map to Medicare Enrollment article, you will be more confident in your knowledge of Medicare, become more familiar and confident with the Medicare enrollment process, and have a better foundation for your healthcare coverage in retirement.

WHAT IS MEDICARE

Most people do not realize that Medicare is the National Health Insurance program for Americans 65 years of age and older, as well as those who have been granted a full-time disability by the Social Security Administration. Medicare is not for the Poor or Homeless. Medicaid is health insurance for individuals whose income is below national guidelines, and for those who need extra help. Medicare is the best option for individuals when they reach age 65. And, most people can keep their current Employer Group Health Insurance after they turn 65 (As long as their employer has over 20 employees). Then, they can easily enroll in Medicare once they finally decide to retire.

DOES EVERYONE WHO APPLIES FOR MEDICARE GET MEDICARE?

As a general consensus the majority of people qualify for Before you start trying to figure out how to enroll in Medicare, you first want to ask when you can sign up for Medicare.

You’d think the questions “How old do you have to be to qualify for Medicare?” or “What is Medicare eligibility age?” would be easy to answer. However, the criteria can be more complex than you’d expect. Generally, most people become qualified for Medicare when they turn 65.

However, there are exceptions for those with certain disabilities or medical conditions. If you are under 65, receiving Social Security Disability Insurance (SSDI) for at least 24 months, or have been diagnosed with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), you can qualify for Medicare before 65.

UNDERSTANDING THE FOUR PARTS OF MEDICARE

Trying to figure out how to apply for Medicare is a key step when starting your Medicare journey, but understanding how Medicare works should also be at the forefront of your to-do list.

Knowing these parts and how they cover your healthcare services will make the Medicare process easier when selecting the most suitable coverage for your healthcare needs in retirement. Once you understand the basics, you can ask more directly related questions, such as “When can I get Medicare?” or “Where do I sign up for Medicare?”

These are the different parts of Medicare, each covering different areas of your healthcare services:

MEDICARE Part A

Medicare Part A provides coverage for your inpatient hospital, skilled nursing facility care, hospice care, and certain home health care services. Part A comes from the federal government.

MEDICARE Part B

Part B covers outpatient medical services, such as doctor visits, preventive services, lab work, and physical therapy. Like Part A, Part B comes from the federal government.

MEDICARE Part C

Another name for Medicare Part C is Medicare Advantage. These plans are managed through private insurance companies. A Medicare Advantage plan includes Part A and Part B benefits and often additional coverage, such as prescription drug insurance and dental and vision benefits.

MEDICARE Part D

Medicare Part D covers the prescription medications you’d pick up at the pharmacy. You enroll in a Part D plan through a private insurance carrier to help cover the cost of drugs.

STEP-BY-STEP ENROLLMENT GUIDE

When starting the Medicare enrollment process, the steps can vary depending on your circumstances.

For Example:

If you’re already receiving Social Security benefits at least four months before your 65th birthday month, you do not need to worry about how to apply for Medicare at 65 because you will be automatically enrolled in Medicare Parts A and B. Your Medicare card should arrive a few months before your birthday month, and your benefits will become effective on the first of your 65th birthday month (unless your birthday starts on the 1st).

If you’re not receiving Social Security benefits, you’ll apply for Medicare through the Social Security Administration (SSA) during your Initial Enrollment Period. This enrollment process can be completed online, by phone, or in person at your local SSA office.

If you become eligible for Medicare but delay your enrollment, you can qualify for a Special Enrollment Period (SEP) or the General Enrollment Period (GEP), depending on your circumstances.

If you are receiving Social Security Disability Income benefits for at least 24 months, you qualify for Medicare.

THE MOST COMMON MEDICARE BENEFICIARIES MAKE WHEN ENROLLING IN MEDICARE

Once you realize the transition to Medicare might be more complicated than expected, the right question to ask yourself is, “How do I correctly apply for Medicare."

There are some common missteps you want to avoid as they could lead to coverage gaps or financial penalties:

If you miss your Initial Enrollment Period (IEP) and do not have creditable employer coverage, you could face permanent late enrollment penalties.

Although technically voluntary, not enrolling in a Medicare Part D prescription plan when you become eligible could mean a lifetime financial penalty.

As we previously stated, Medicare has four main parts, but there are many Medicare plans as well. Understanding the concepts and differences between Original Medicare, Medicare Advantage, and Medicare Supplement plans will help prevent confusion when selecting your coverage.

YOU MISSED YOUR MEDICARE ENROLLMENT DEADLINE. NOW WHAT DO YOU DO?

If something happens, and you miss your Medicare enrollment deadline, don’t panic. You can still enroll in Medicare during the yearly General Enrollment Period or, if you qualify, a Special Enrollment Period (SEP). One qualifying reason for a SEP could be the loss of employer-sponsored health coverage.

HELP WITH DETERMINING WHICH MEDICARE OPTION IS BEST FOR YOU AND YOUR FAMILY

When it comes down to choosing your Medicare plan, there are multiple factors to consider before a final decision. Consider your health and which benefits are most important to you. Compare costs, such as monthly premiums, deductibles, copayments, and coinsurance. Are you okay with a provider network? Do you want access to a wide range of healthcare providers?

Consider all of these factors when evaluating which route you want to take.

MEDICARE FAQ

WHERE DO I HAVE TO GO TO ENROLL IN MEDICARE?

The most common way to apply for Medicare is online through Social Security’s website, following the instructions. You can also call Social Security or visit your local SSA office.

WHEN IS THE BEST TIME TO APPLY FOR MEDICARE?

You can apply as early as three months before your 65th birthday month during your 7-month Initial Enrollment Period (IEP). Your IEP begins three months before your 65th birthday and ends three months after it (unless your birthday falls on the first of the month). When you apply during the three months before your 65th birthday month, your Medicare benefits become active on the first of your birthday month.

WHAT IS THE BEST WAY TO ENROLL IN MEDICARE?

Medicare beneficiaries will apply through the Social Security office. Apply for Medicare online through Social Security’s website.

IS MEDICARE EXPENSIVE?

The cost of Medicare typically changes annually. Medicare Part A is premium-free for most people because they have enough work credits and paid Medicare taxes over the years. Everyone pays a monthly premium for Part B (unless you qualify for Medicaid). The standard Part B premium in 2026 is $202.90. But the final determination on what you will pay for your Medicare premiums is made by the Social Security Administration based on your income. If your income is higher, you pay more for your Part B and D premiums. The costs can vary for specific plans since the rest of your Medicare plan options come from private insurance carriers. Check out our Medicare costs page to learn more.

CAN I ENROLL IN MEDICARE PART A WITHOUT ENROLLING IN MEDICARE PART B?

If you plan to delay Medicare Part B, you can sign up for Part A only on the Social Security website. And, since 99% of people pay no premiums for Medicare Part A, it makes good common sense to enroll in Medicare Part A as soon as you turn 65.

WHAT'S THE BEST WAY TO ENROLL IN MEDICARE PART B?

If you have Part A already but need Part B, select “Part B only” when on the SS website or go to sign up for Medicare Part B only. However, if you are applying for Part B because you qualify for a SEP, you will submit CMS form L564 in addition to your Part B application.

STEPS TO TAKE IN ORDER TO RECEIVE YOUR MEDICARE CARD

Once you apply for Medicare and your application is approved, you will receive your card. Social Security may take some time to process your application. Therefore, it may be several weeks before you receive your card. You should also be able to check your SSA account to see if your Medicare number is available.

ARE YOU ALLOWED TO KEEP YOUR CURRENT HEALTH PLAN WHEN YOU ENROLL IN MEDICARE?

Depending on your coverage, it may be considered primary or secondary to Medicare. You would need to contact your current plan directly to understand how it would coordinate with Medicare. If your current coverage is through the ACA, you would need to cancel it once you have Medicare. These two do not coordinate.

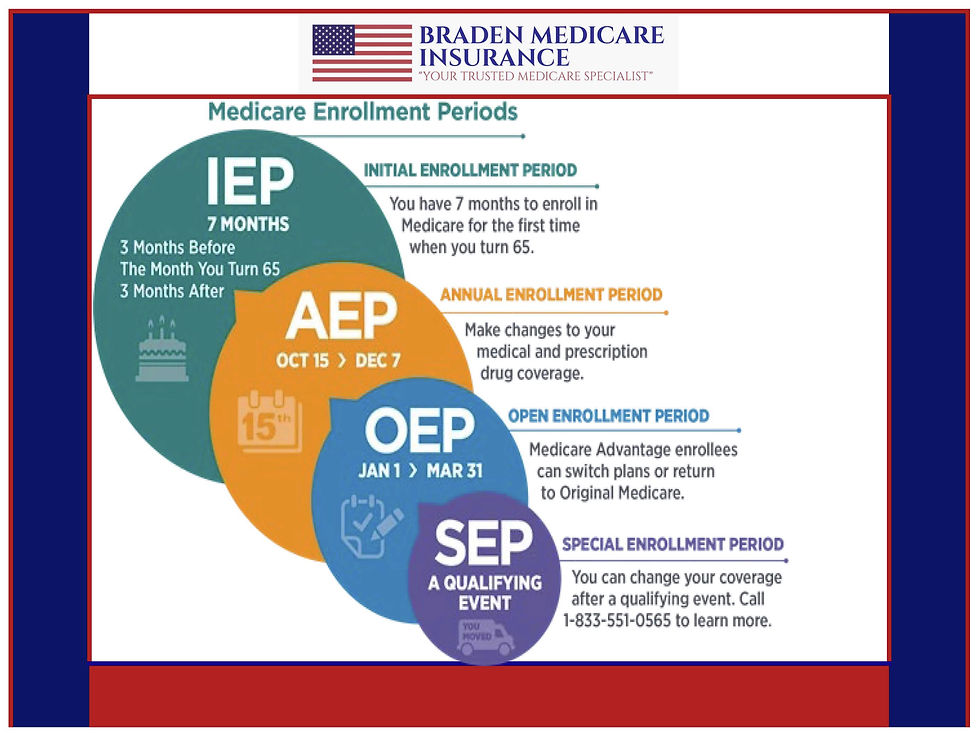

WHAT ARE THE DIFFERENT ENROLLMENT PERIODS AVAILABLE WITH MEDICARE?

The Annual Election Period (October 15 – December 7) allows beneficiaries to make changes to their Medicare Advantage or Part D plans.

WRAPPING THINGS UP

Hopefully, you can better understand how to qualify for Medicare and navigate the enrollment process. Once you are armed with the correct information about Medicare, you will be in a better position to make informed decisions to ensure you have the right Healthcare plan for you and your family.

In my opinion, the absolute best thing anyone can do when it comes time to learn about Medicare is to work with a licensed, independent Medicare Broker.

WHY WORKING WITH A MEDICARE BROKER MAKES THE MOST SENSE:

There is no charge to you for working with a Medicare Broker.

Brokers deal with Medicare every day, not just once in a lifetime.

Brokers know all of the rules and regulations that the normal American will never know or understand.

You can do a quick GOOGLE search and find Medicare Brokers Close To Me. Then call 2-3 of these Medicare Brokers and interview them. See what they sound like, are they educated in Medicare? Are they open or arrogant? Do they push one option over others? Do they create pressure on you or make you feel uneducated? Ask them how many companies they are contracted with. Ask them whether they have a website and provide their email address.

A reputable broker should have an email that matches their webpage. Ask them to give you an overview of Medicare and what options you have.

Ask them if they have BBB Accreditation.

Any broker worth their salt will be happy to assist you and answer all of your questions. Brokers choose this career because they are service-oriented and genuinely enjoy helping others.

_AZ_Initial.png)