MEDICARE & PRE-EXISTING CONDITIONS

- Michael Braden

- Dec 30, 2025

- 7 min read

Michael T. Braden December 31, 2025 MEDICARE 101

In today's article, we will discuss and explain what pre-existing conditions are covered and accepted by Medicare. Yes, Medicare does cover pre-existing medical conditions. From the moment you enroll, Medicare ensures that you receive the treatment and care you need, regardless of your health. However, certain exceptions and specifics apply depending on the type of Medicare plan you choose.

PRE-EXISTING HEALTH CONDITIONS AND MEDICARE

When it comes to preexisting health issues, Medicare shines as a beacon of accessibility. Unlike many private health insurance plans, Medicare ensures that most chronic and preexisting medical conditions are covered from the moment you become eligible. This means that as soon as you enroll, you have immediate access to a broad range of medical services without the worry of waiting periods or denial based on your medical history.

Original Medicare, which includes Medicare Part A (hospital) and Part B (medical), offers extensive coverage for various medical services and treatments. This is particularly reassuring for Medicare beneficiaries with chronic conditions, as there are no restrictions or waiting periods imposed based on their condition.

Medicare Part C, also known as Medicare Advantage plans, plays a crucial role in covering pre-existing medical conditions. These plans, provided by private insurance companies, are required by federal law to offer coverage equivalent to Original Medicare, without waiting periods or exclusions for pre-existing conditions.

PRE-EXISTING COVERAGE WITH ORIGINAL/TRADITIONAL MEDICARE

Original Medicare consists of Medicare Part A and Medicare Part B. Medicare provides beneficiaries with comprehensive health insurance coverage for hospital and medical services, respectively. From the first day of your eligibility, Medicare ensures that your prior medical conditions are covered, allowing you to receive necessary treatments and care without delay. This is significant relief for those who depend on timely medical services to maintain their health.

However, there are a few exceptions, such as services related to an open workers’ compensation or an active automobile insurance claim, which may not be covered. Knowing which exceptions apply helps avoid unexpected out-of-pocket expenses.

MEDICARE SUPPLEMENTS AND MEDIGAP PLANS

Medigap policies, also known as Medicare supplement plans, are designed to fill the gaps left by Original Medicare. These policies can be particularly beneficial for individuals with preexisting health conditions, as they help cover out-of-pocket expenses such as copayments, coinsurance, and deductibles. However, obtaining Medicare supplement coverage can be more complex for those with preexisting conditions, as medical underwriting is conducted outside the Medigap Open Enrollment Period.

WHAT ARE GUARANTEE ISSUE RIGHTS?

Guaranteed Issue rights protect Medicare beneficiaries with pre-existing conditions. During specific periods, such as the six-month Open Enrollment window after enrolling in Medicare Part B, Medigap insurers cannot decline your coverage based on your health status. This allows beneficiaries to purchase any available Medigap plan without the fear of rejection due to existing health concerns. To qualify for these rights, you must be eligible and enroll within the designated timeframe to ensure complete protection. Missing this window may affect your ability to access specific Medigap plans without medical underwriting or a waiting period.

MEDICARE SUPPLEMENT AND MEDIGAP PLANS CAN INCLUDE WAITING PERIODS

While traditional Medicare does not impose restrictions based on preexisting medical conditions, Medigap policies can have different rules. Some Medigap insurers may impose a waiting period of up to 6 months for coverage of pre-existing conditions, especially if you lacked continuous prior healthcare coverage. However, this waiting period can be avoided by enrolling during your Medicare Initial Enrollment Period or by having creditable coverage before enrolling in Medigap.

Additionally, beneficiaries under 65 with a disability may face additional barriers when seeking a supplement plan, as federal law does not require insurers to sell Medigap policies to them. Many states have their own laws about under-65 supplement policies, requiring insurers to offer at least one plan during a Guaranteed Issue period. However, availability and plan types vary significantly by state.

MEDICARE PART C (MEDICARE ADVANTAGE PLANS) AND PRE-EXISTING CONDITIONS

Medicare Advantage plans must cover preexisting medical conditions and provide necessary healthcare services without delay. However, it is crucial to understand the challenge of switching from a Medicare Advantage plan to Original Medicare. Those with prior health conditions who wish to switch may struggle to obtain a Medigap policy due to medical underwriting. This highlights the importance of selecting the right health insurance coverage initially, as it may be the plan you end up staying with long-term.

RESTRICTIONS WITH MEDICARE PLAN NETWORKS

Network restrictions are a common feature of many Medicare Advantage plans. These restrictions dictate which healthcare professionals and facilities beneficiaries can use, potentially limiting access to preferred doctors and specialists, especially for individuals with complex health needs. It’s essential to review the network specifications of any plan you consider to ensure it meets your healthcare needs. Because private insurance companies offer these plans, they use preferred networks as a cost-management tool. By keeping expenses manageable, they can include additional plan benefits at no extra cost to the policyholder.

ADDITIONAL BENEFITS OFFERED BY MEDICARE ADVANTAGE PLANS

Medicare Advantage plans often offer additional benefits beyond standard Medicare coverage, which can be particularly useful for managing pre-existing medical conditions.

These extra services can include:

Wellness programs (like preventive services and gym memberships),

Vision care,

Dental care, and

Prescription drug coverage.

These benefits provide comprehensive support for your health needs and can significantly enhance your overall health and well-being.

For individuals with chronic conditions, the supplementary services offered by many Medicare Advantage plans, such as preventive care resources, can be invaluable. These added benefits can help manage health issues more effectively and improve your quality of life, providing more details on how to enhance your overall well-being.

MEDICARE PART D AND PRE-EXISTING CONDITIONS

MEdicare Part D is the part of Medicare that covers Prescription Medications. For many individuals, prescription drug coverage is a vital component of managing their health, including pre-existing conditions. Medicare Part D ensures that beneficiaries have access to necessary medications. Part D prescription Drug plans provide coverage for prescription medications, including those required for chronic conditions, without imposing higher costs based on health status. This ensures equitable access to medicines for all enrollees.

WHAT ARE SPECIAL ENROLLMENT PERIODS FOR PEOPLE WITH PRE-EXISTING CONDITIONS?

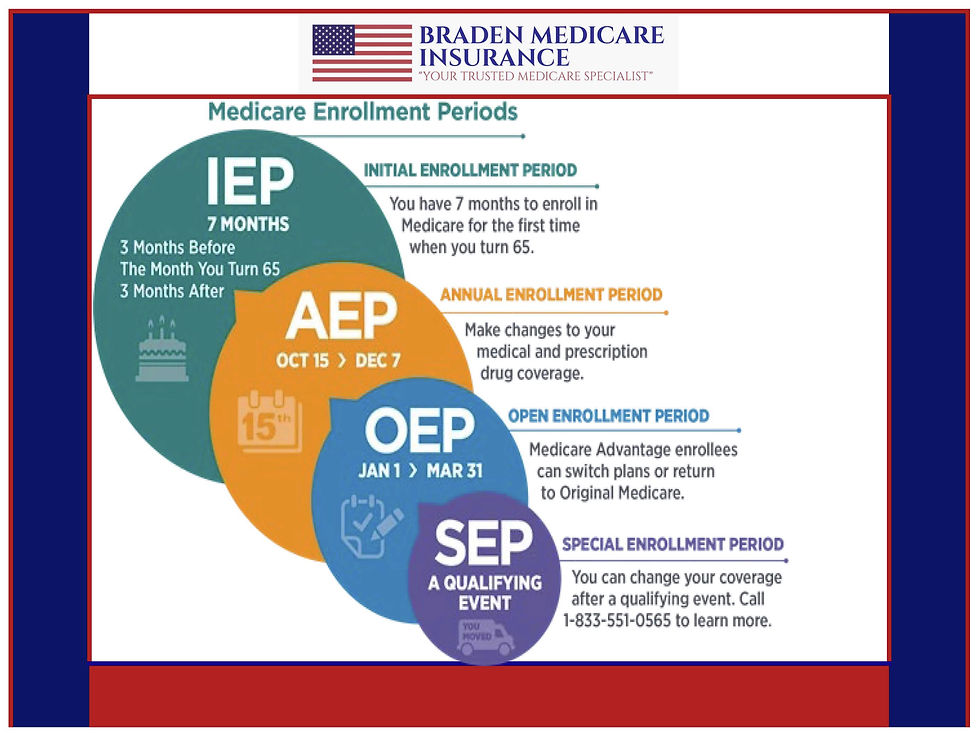

Special Enrollment Periods (SEPs) are vital for individuals with pre-existing medical issues, enabling changes to Medicare plans following significant life events that occur outside an Open Enrollment Period. Utilizing a Special Enrollment Period will help maintain continuous and comprehensive health coverage after a qualifying event.

POSSIBLE CHALLENGES AND SOLUTIONS

While Medicare covers pre-existing conditions, beneficiaries may still face challenges in accessing optimal care. Restrictions in Medicare Advantage plan networks can limit access to preferred doctors and specialists, and out-of-pocket costs for frequent or extensive care can increase without supplemental health insurance coverage.

For those on traditional Medicare, the optimal timeframe to qualify for a Medigap policy is within the first six months of enrolling in Medicare Part B. This Open Enrollment window ensures beneficiaries are eligible to enroll in Medigap regardless of their health condition. This coverage can help manage costs associated with increased healthcare needs that can result from having a chronic health condition.

THE BEST WAY TO COMPARE AND CONTRAST YOUR MEDICARE OPTIONS

When evaluating your Medicare healthcare options, consider factors such as Medicare Advantage networks, Medigap policy benefits, the availability of prescription drug plans, and how these components may work together to meet your healthcare needs. It is essential to understand what costs you may be responsible for under each option.

It is a fact that Medicare Supplement plans have additional premiums when compared to MA & MAPD plans, but they virtually eliminate any other Out-Of-Pocket expenses you may have, after the annual Medicare Part B Deductible is met. The projected Part B Deductible is just $283 for 2026.

Even though Medigap/Medicare Supplement policies often have higher premiums than Advantage plans, they help cover out-of-pocket costs such as copayments, coinsurance, and deductibles, making them a valuable option for those seeking more comprehensive financial protection. It also helps to know what your premium is without having to keep a separate Rainy Day Fund for Health emergencies.

Qualifying for Medigap during your Initial Enrollment Period can help you avoid medical underwriting and waiting periods, ensuring immediate coverage for any existing health conditions.

WRAPPING THINGS UP

Pre-Existing conditions are a regular part of healthcare; very few people are perfect, with no health maladies or past health issues that might affect them in retirement. This is why I wanted to share and educate Medicare beneficiaries about pre-existing conditions under Medicare.

Unlike your current or past Healthcare plans, I honestly believe you will come to view Medicare as I do. Medicare, especially Original Medicare with a Medicare Supplement Policy Plan G, is absolutely the best, most affordable, and most comprehensive health plan you will ever have.

Braden Medicare Insurance is a licensed, Independent Medicare Broker and a CMIS (Certified Medicare Insurance Planner. We are based in Arizona and licensed in AZ, CA, CO, IA, IN, FL, MI, NM, NV, OH, OR, PA, TX, and WI.

If you have any questions about Medicare or Medicare Pre-Existing conditions, please feel free to reach out to me anytime. My email address is mike@bradenmedicare.com. You can also reach me by phone or text at (480) 225-1393,

Please remember that I started my business 10 years ago to help and support Medicare Beneficiaries. We have never charged a penny for any of our services, advice, or opinions. We are in the business of teaching and explaining all aspects of Insurance for those 60 and over. We honestly care about our clients, we treat our friends like family, and we speak Medicare fluently.

_AZ_Initial.png)