HOW DO YOU CHOOSE THE RIGHT MEDICARE PLAN FOR YOU AND YOUR NEEDS

- Michael Braden

- Sep 9, 2025

- 4 min read

Updated: Dec 28, 2025

Michael T. Braden August 21, 2025 Medicare 101

THE QUESTION "HOW TO CHOOSE THE RIGHT MEDICARE PLAN FOR YOU AND YOUR NEEDS" MAY SOUND SIMPLE, BUT IT IS SO TRUE. YOU NEVER WANT TO GET A PLAN BASED ON OTHER PEOPLE'S RECOMMENDATIONS, BECAUSE OTHER PEOPLE AREN'T YOU.

Choosing the right Medicare plan can feel overwhelming. With multiple options available, it is essential to understand what each plan offers and how it aligns with your personal health needs and budget. This guide will help you navigate the different Medicare coverage options, clarify common questions about costs, and provide practical tips to make an informed decision.

TO CHOOSE THE RIGHT MEDICARE PLAN, YOU FIRST NEED TO UNDERSTAND ALL OF YOUR OPTIONS WITH MEDICARE

Medicare is a federal health insurance program primarily for people aged 65 and older, but it also covers some younger individuals with disabilities. When you become eligible, you have several coverage options to consider:

Original Medicare (Part A and Part B): This is the traditional government-run plan. Part A covers hospital stays, skilled nursing, and some home health care. Part B covers doctor visits, outpatient care, and preventive services.

Medicare Advantage (Part C): These are private insurance plans approved by Medicare that combine coverage for Part A and Part B. Many also include prescription drug coverage and additional benefits, such as vision, dental, and wellness programs.

Medicare Prescription Drug Plans (Part D): These plans provide drug coverage in addition to Original Medicare or certain Medicare Advantage plans.

Medicare Supplement Insurance (Medigap): These plans help pay some out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Each option has pros and cons depending on your health needs, budget, and preferences. For example, if you want more predictable costs and extra benefits, a Medicare Advantage plan might be suitable. If you prefer flexibility in choosing providers, Original Medicare with a Medigap plan may be a better option.

TIPS ON DETERMINING AND CHOOSING THE RIGHT PLAN FOR YOU

Selecting the right plan requires careful consideration of several factors:

Assess Your Health Care Needs:

How often do you visit doctors or specialists?

Do you need regular prescription medications?

Are you managing any chronic conditions?

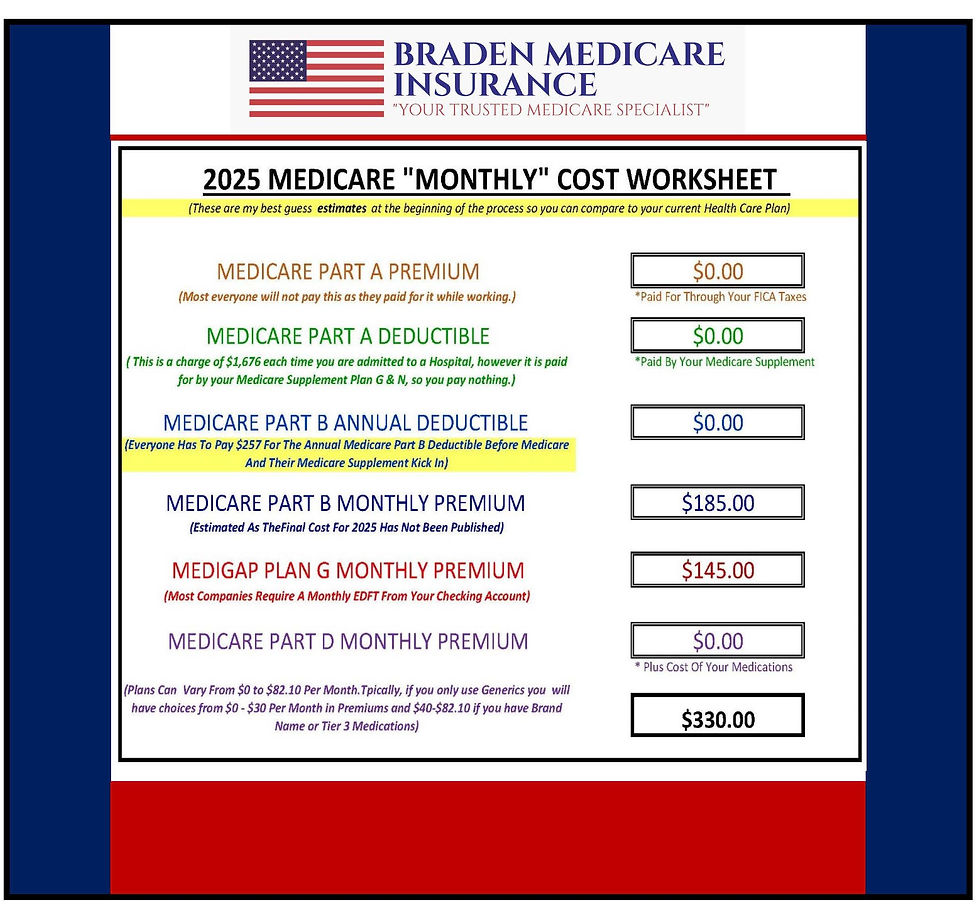

Compare Costs:

Look at premiums, deductibles, copayments, and coinsurance.

Consider your budget and how much you can afford monthly and annually.

Check Provider Networks:

If you have a preferred doctor or hospital, verify if they accept the plan.

Some Medicare Advantage plans have limited networks.

Review Extra Benefits:

Some plans offer vision, dental, hearing, or wellness programs.

Decide if these extras are important to you.

Understand Coverage Rules:

Some plans require referrals or prior authorizations.

Know the rules to avoid surprises.

Use Online Tools and Resources:

The official Medicare website and trusted advisors can help you compare plans side by side.

By taking these steps, you can narrow down your options and select a plan that balances coverage and cost effectively.

DOES EVERYONE PAY $187 A MONTH FOR MEDICARE?

A common question is whether everyone pays the same monthly premium for Medicare. The answer is no. The standard Part B premium amount can vary based on income and other factors. For example:

The base premium for Part B in 2025 is approximately $187.00 per month.

Higher-income beneficiaries may pay more based on their modified adjusted gross income.

Some people qualify for assistance programs that reduce or eliminate premiums.

Additionally, Part A is usually premium-free if you or your spouse paid Medicare taxes while working. However, if you do not qualify for premium-free Part A, you may have to pay a monthly premium.

Understanding these details helps you budget accurately and avoid unexpected costs. It is also essential to review your plan annually during the Medicare Open Enrollment Period to ensure your coverage and costs still meet your needs.

ADVICE WHEN IT COMES TO CHANGING, SWITCHING, AND ENROLLING IN A MEDICARE PLAN

Enrolling in Medicare or switching plans can be confusing, but following these tips can simplify the process:

Sign up on time:

The Initial Enrollment Period starts three months before you turn 65 and lasts seven months. Missing this window can lead to penalties.

Review your plan annually:

During the Open Enrollment Period (October 15 - December 7), you can change plans if your needs or plan options change.

Seek professional advice:

Licensed Medicare counselors or agents can provide personalized guidance.

Keep track of deadlines:

Late enrollment can result in higher premiums or gaps in coverage.

Understand your rights:

You can appeal decisions or file complaints if you experience issues with your plan.

By staying informed and proactive, you can maintain coverage that aligns with your evolving health and financial needs.

HOW YOU CAN GET THE MOST FROM YOUR PREFERRED MEDICARE PLAN

Once you have chosen a plan, maximize its benefits by:

Using preventive services:

Medicare covers many screenings and vaccines at no cost.

Managing prescriptions wisely:

Use preferred pharmacies and generic drugs when possible.

Keeping records:

Track your medical expenses and claims to avoid billing errors.

Communicating with providers:

Ensure they accept your plan and understand the coverage it provides.

Staying informed:

Medicare rules and plans can change, so keep up to date.

Taking these steps helps you get the best value and care from your Medicare coverage.

Choosing the right Medicare plan is a critical decision that impacts your health and finances. By understanding the different Medicare coverage options, costs, and enrollment rules, you can confidently select a plan tailored to your needs. For more detailed information and personalized assistance, visit medicare.

_AZ_Initial.png)